Market Volatility: A Closer Look at the Opportunity in Front of Us

With the recent volatility in the stock market, it’s completely natural to feel some concern. Headlines can make it seem like the sky is falling, and short-term drops can feel unsettling—even if you’ve experienced them before. The S&P has fallen over 10% in the last two trading days, and today has been volatile, too. Historically, this is a reason to buy, not a reason to sell.

But here’s what we want you to remember:

Market downturns aren’t new. They’re part of the process.

In fact, they’ve happened many times before—and each time, they’ve brought opportunity for long-term investors who stayed the course.

Let’s look at the bigger picture:

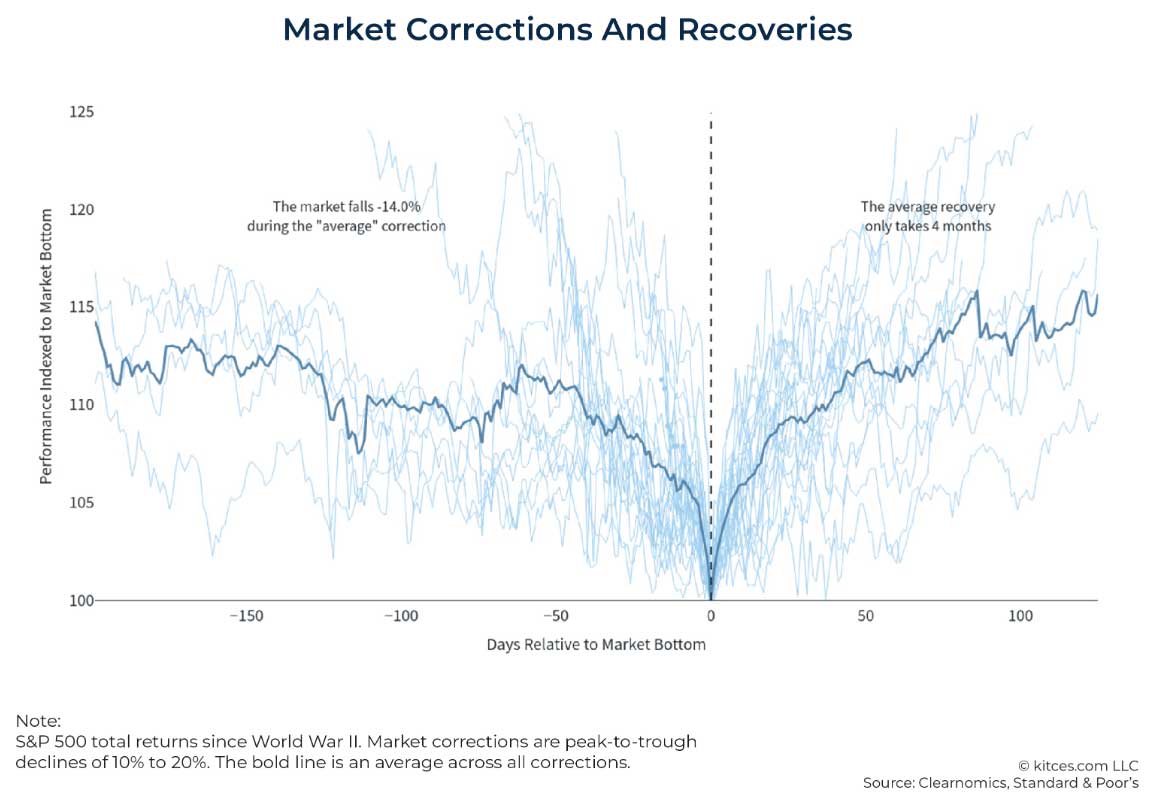

- Since WWII, the S&P 500 has experienced an average decline of 14% during a correction. Typically, recovery takes about 4 months.

- Despite this, the market has gone on to recover 100% of the time, with long-term investors being rewarded for their patience.

- For example, during the Great Financial Crisis in 2008, the market fell over 50%. But from the bottom in March 2009, it went on to climb over 400% over the next decade.

Volatility ≠ Risk:

We often think of volatility as risk, but there is a distinction. Volatility is the price of admission for long-term growth. True risk is abandoning your plan, selling at the bottom, or sitting on the sidelines while inflation erodes your purchasing power.

When the market drops, it’s not necessarily a sign to get out. For long-term investors, it’s often a chance to get in—or to stay in and accumulate more.

Why This Can Be an Opportunity:

Stocks are “on sale”:

When the market pulls back 10%, 15%, or even 20%, the value of quality companies doesn’t disappear—it just becomes more affordable. That’s a potential buying opportunity.

Dollar-cost averaging works in your favor:

If you’re contributing regularly to retirement or investment accounts, you’re automatically buying more shares at lower prices. Over time, this helps reduce the average cost per share and can boost long-term returns.

Tax-loss harvesting:

For taxable accounts, downturns may allow us to harvest investment losses to offset gains elsewhere—reducing your overall tax bill while staying invested.

What You Can Do:

Limit your news intake:

Stay informed, but don’t let headlines drive your decisions. The news is designed to capture attention—not to make you a better investor. Too much of it can lead to fear-based choices.

Check your cash reserves:

Generally, you should have 3 to 12 months of expenses in cash. This cushion can give you peace of mind and the confidence to leave your long-term investments alone.

Align investments with your timeline:

Long-term money (15+ years) should be invested accordingly. If you don’t need the money soon, we generally recommend you stay the course.

Revisit your “why”:

You’re investing to reach specific goals. Sitting on the sidelines can be riskier than staying invested—especially when it comes to inflation and long-term growth. If your goals have changed, please reach out to us so that we can review your portfolio and make adjustments if needed.

Stick with what works:

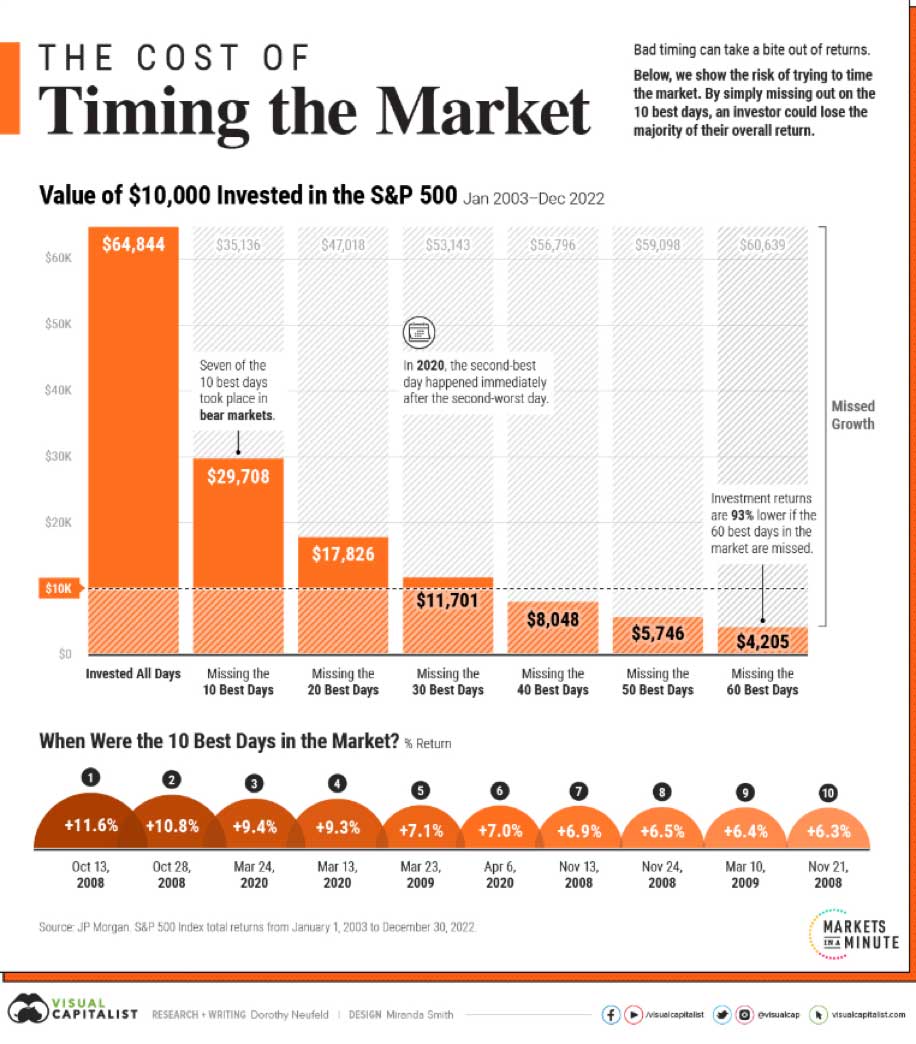

Owning a diverse mix of great businesses has historically rewarded patient investors. Trying to time the market or going all-cash often leads to worse outcomes.

Use losses wisely:

Tax-loss harvesting might help offset gains or allow you to rebalance more effectively—if it fits your overall strategy.

Don’t treat long-term money like a short-term trade:

No one can consistently outguess the market. Long-term investing has historically outperformed quick fixes and emotional reactions.

Control what you can:

You can’t control markets—but you can manage your savings rate, spending, taxes, asset mix, estate plan, risk exposure, and emotions. Focus there.

Bottom Line:

Yes, the market is experiencing turbulence. But that’s not a reason to panic—it’s a reason to stay grounded. This could be one of the better opportunities we’ve seen in recent years to invest at more favorable prices. If you have some cash that is not needed in the near-term, we highly recommend you consider investing it. For those of you contributing to retirement accounts, keep it going or consider increasing those deferrals.

If you’d like to review your financial plan, rebalance your portfolio, or simply talk through how you’re feeling about all this, we are here. We’ve planned for this, and we’ll get through it—together.