What’s Your Perspective?

By: Jamie Stone, Chief Planning Officer

“…you know what I’m craving? A little perspective. That’s it. I’d like some fresh, clear, well-seasoned perspective.” – Anton Ego (Ratatouille).

As the father of three young boys, most of my cultural references these days are from some sort of children’s programming. But I love this scene in the movie Ratatouille where the food critic Anton Ego (voiced by Peter O’Toole) reminds young Linguini of the importance of maintaining a proper perspective.

As we sit here closing in on the halfway point of 2022, many of us feel there is much going on in the world around us, from markets and the economy, to supply chains and inflation, plus international and geopolitical crises. And there is a lot going on!

Through May 27, the S&P 500, an index of large U.S. stocks, is down a little over 12.2% year to date. Year over year inflation, as measured by the Consumer Price Index, is up 8.3% through April. The Fed has raised rates by 0.75% so far this year and has pledged to start selling its bond holdings by 95 billion dollars per month, to reduce its 9 trillion-dollar balance sheet. Supply chain snarls, domestic and international, continue and there is much talk about recession and bear markets.

So, what can we do with this information? How does it affect us and our financial plans? What can we do about it?

Really, a lot of it can depend on our perspective.

Our eyes have something called accommodation, which is the basic function of allowing us to change focus from something far to something near. When our eyes relax and focus back on something far, we have something called optical infinity. You’ve experienced this if you’ve ever looked at something far away through a window or fence and after a while may have even forgotten the object you were looking through was there. The reverse of this is also true. If we focus on something near, we can’t clearly see something in the distance. This is why, in part, we have the saying “Can’t see the forest for the trees.”

Maintaining the proper perspective can be critical to having a successful financial plan. I often tell clients my job is to help them focus on what they can control so they can become less focused on what they can’t.

I also make one guarantee to clients about their investments: between now and the end of your plan, you will experience volatility in your portfolio. But what does this really mean? Volatility is often more frequent than many people realize.

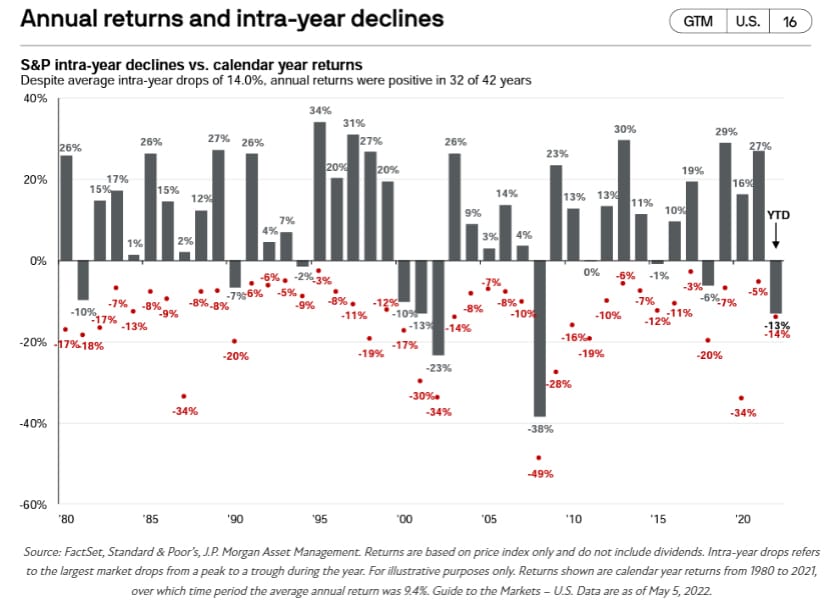

If we focus on intra-year market declines, which average -14%, do we lose perspective that 32 out of the last 42 years the market ends up with a positive annual return? Could this lead us to make poor decisions with our investments because we’re focused on the near-term rather than the long-term? Since 1950, in the 10 times stocks have fallen 20%, three, six- and twelve-months later stocks were up, on average 3.8%, 3.6%, and 14.8%, respectively (data from Bloomberg, as of 5/27/2022). While past performance does not guarantee future results, focusing on what may be temporary and short-lived can move us off our path to long-term success.

Unfortunately, investors fall into this trap all the time and suffer the consequences because of it.

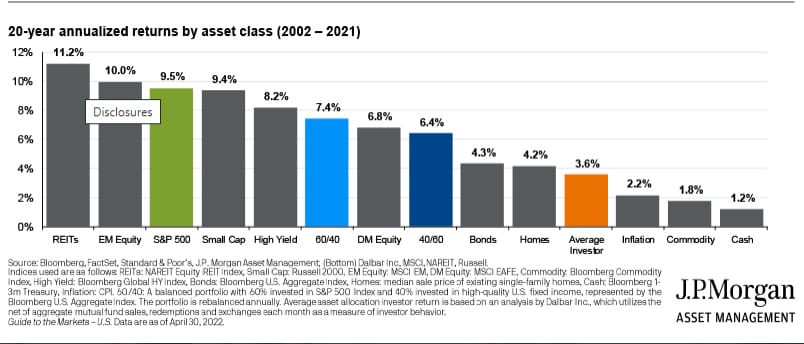

The chart above is personally important to me because it lines up closely with my career in wealth management. I began working with clients at the end of 2001. Over my twenty-year career I’ve experienced numerous market corrections, bear markets, and recessions. And yet, I’ve also seen clients who had a plan and stuck with the plan successfully navigate turbulent times. But the key was to have a plan and to give the plan time to work.

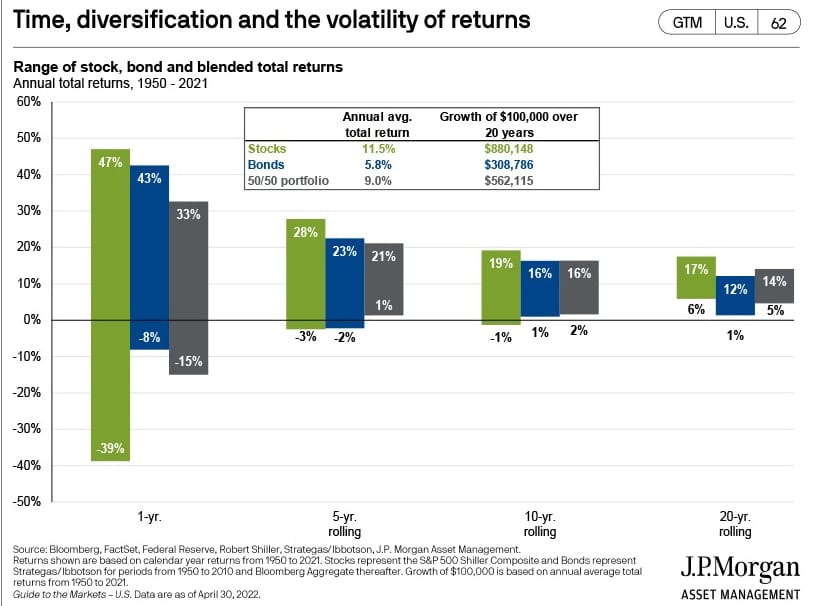

Most of us would prefer the relatively smooth flying returns on the right of the chart above. So how do we move out of the “return to your seats, fasten your seat belts, lights flashing, overhead bins flying open, babies crying” turbulence on the left? By zooming out, having a plan, and sticking with it. If your portfolio is well diversified and in an allocation that fits the goals and objectives of your plan, I believe the best money manager in the world is time. But if we disrupt our plan and make unforced errors, like trying to market time (this includes moving in and out of cash), we reset ourselves back to a focus on the bumpy skies of annual market volatility. We often tell our clients that your investments should be dictated by your financial plan—your plan should not be dictated by your investments.

That doesn’t mean there aren’t things you should do, but this gets back to my earlier point about focusing on what you can control versus what you can’t control.

So, what can you do, not just during what may seem like tough times, but throughout the life of your financial plan?

- Have a plan. Review and update it frequently.

- We are here to help you develop and maintain a holistic financial plan. As life happens, we will update and pivot as needed, all while helping to chart a course that will help you successfully reach your vision and goals.

- Revisit the plan if you have concerns.

- We stress-test our plans against a full spectrum of return possibilities in your portfolio. We won’t present a plan as successful if it’s on a razor’s edge. We plan for rough patches in the market and by reviewing your plan, you’ll see that you can still be successful, despite what may currently be happening.

- Take small, positive steps over time that can add up to additional success down the road.

- Seemingly insignificant things like contributing to your retirement accounts, rebalancing your portfolio, tax-loss harvesting, or Roth conversions can add up over time and increase the success of your plan.

At Means Wealth Management we are committed to putting the interest of our clients first and foremost and we are here to help. Whether you are in retirement, nearing retirement, or have thirty years to go, we stand ready to help you keep the right perspective on your journey through a successful financial plan. If you have questions or need clarification about your plan, please reach out to us.