Staying the Course During Market Volatility

“The most important quality for an investor is temperament, not intellect” – Warren Buffett

Market corrections can be unsettling, and the recent volatility has left many investors wondering what’s next. According to the American Association of Individual Investors (AAII), last week’s sentiment reading revealed some of the lowest levels of optimism and the highest levels of pessimism in its 37-year history. While this extreme sentiment reflects broader economic concerns ranging from inflation and interest rate uncertainty to geopolitical tensions and recession fears, history has shown that market corrections are a natural part of long-term investing.

The Role of Trade Policies in Market Volatility

Trade policies, including tariffs and economic agreements, can significantly impact markets by affecting global supply chains, corporate earnings, and overall economic growth. When trade tensions rise, markets often react with short-term declines as investors assess potential impacts. However, businesses and economies have historically adapted, and markets tend to stabilize as new agreements are reached or companies adjust their strategies.

Why a Long-Term Perspective Matters

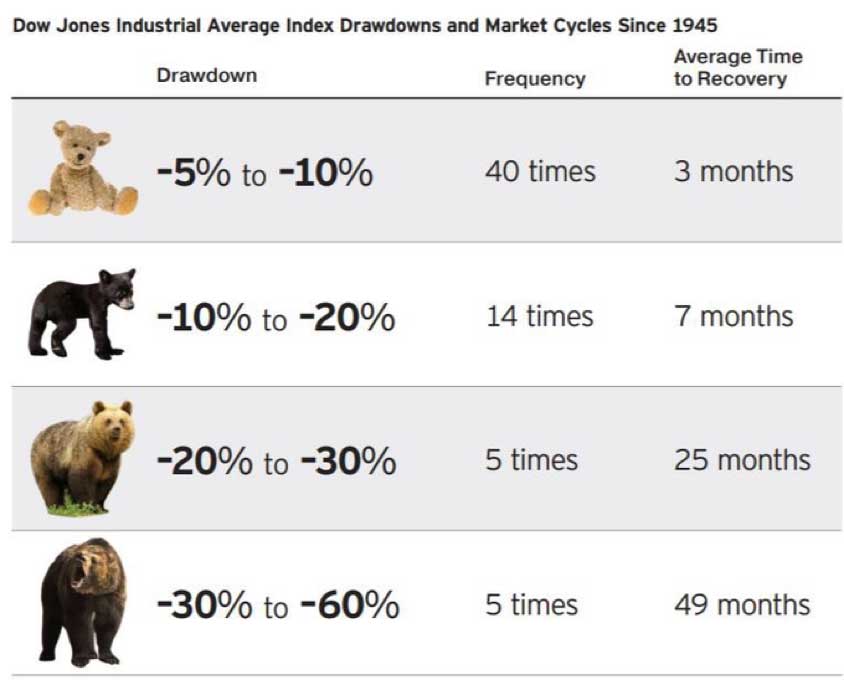

While short-term market swings can be stressful, staying focused on long-term financial goals is crucial. Historically, market corrections—typically defined as a decline of 10% or more from recent highs—occur about once a year. Despite these temporary declines, markets have proven resilient, often rebounding within months.

The chart below illustrates past market corrections and their subsequent recoveries, highlighting the importance of maintaining a long-term perspective.

The S&P 500 has endured numerous corrections (bear markets) over the decades, yet it has consistently trended higher over time. The key to successful investing isn’t avoiding volatility—it’s managing it through discipline, diversification, and a long-term strategy.

Remember:

-

Markets Are Resilient:

Even after major downturns like the 2008 financial crisis or the 2020 pandemic-driven selloff, markets have recovered and reached new highs.

-

Long-Term Focus Wins:

Investors who stay disciplined through downturns typically see stronger returns than those who react emotionally. Selling during a downturn can lock in losses, while those who stay invested often benefit from the recovery.

-

Opportunities for Growth:

Down markets can present strategic buying opportunities. As Warren Buffett famously advised, “Be fearful when others are greedy, and greedy when others are fearful.”

The Power of Staying Invested

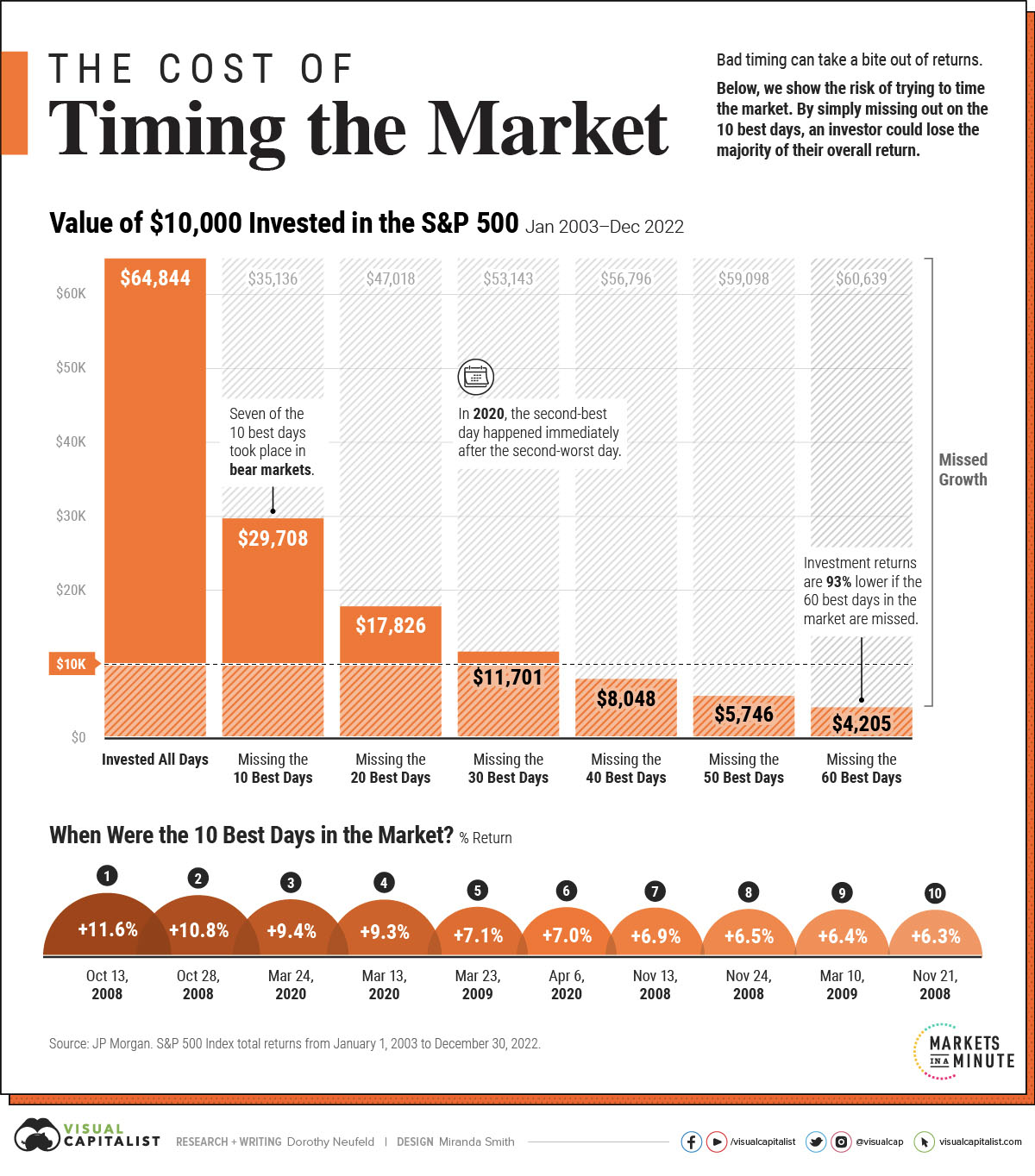

Trying to time the market can be tempting, especially during periods of volatility, but missing just a handful of the best-performing days can have a significant impact on long-term returns. The graphic below illustrates how even a few mistimed trades can drastically reduce overall investment gains. While market downturns can be unsettling, history shows that staying invested and maintaining a long-term perspective often leads to better outcomes than attempting to predict short-term movements. This data serves as a powerful reminder of why patience and discipline are key to successful investing.

What You Can Do Now

-

Stay the Course:

Remember, short-term fluctuations are temporary. Your financial plan is designed to withstand market volatility and help you achieve long-term growth.

-

Review Your Goals:

If your financial situation or goals have changed, we can review your portfolio to ensure it still aligns with your needs and risk tolerance.

-

Consider Buying Opportunities:

If appropriate for your financial plan, market corrections can provide opportunities to invest at lower prices and position yourself for future gains.

We’re Here for You

We know that market volatility can feel unsettling, and it’s completely natural to have concerns during uncertain times. Our role is to provide guidance, reassurance, and strategic insight to help you navigate these fluctuations with confidence. If you have any questions or would like to discuss your portfolio, please don’t hesitate to reach out—we’re always here to support you.