Navigating the Markets and Maintaining Your Financial Plan in an Election Year

By: Jamie Stone, CFP®, ChFC®, Chief Planning Officer

As we move forward in this important presidential election year, many of you may be wondering–or even worrying–about how political events could impact your investment portfolio and overall financial plan. It’s natural to be concerned, especially when significant elections often bring market volatility. However, it’s important to approach this period with a clear strategy and avoid reacting emotionally to market fluctuations. Read on to learn more of what you can expect and how you should (or shouldn’t!) react.

Expect Short-Term Volatility, but Stay Focused on the Long-Term

Historically, election years have typically been marked by heightened volatility. Investors often react to the possibility of shifts in regulations, taxes and government spending that could impact sectors like healthcare, energy, technology and defense. Additionally, the unpredictability of election outcomes can create nervousness, leading to market swings as investors try to anticipate and adjust to potential economic changes under different leadership. Media coverage, polls and debates can also influence market sentiment, causing fluctuations as new information emerges. This heightened uncertainty often drives short-term volatility. However, long-term investors should not let these temporary shifts drive their decision-making.

“The great virtue of a free-market system is that it does not care what color people are; it does not care what their religion is; it only cares whether they can produce something you want to buy. It is the most effective system we have discovered to enable people who hate one another to deal with one another and help one another.” – Milton Friedman

While this quote from Mr. Friedman may seem harsh, it highlights a central truth that applies to free elections within a free-market system. The market’s trajectory is influenced by factors that go beyond presidential elections or specific administration policies. There are too many things beyond the control of any president or administration to completely alter the movement of a free-market system. This is a good thing!

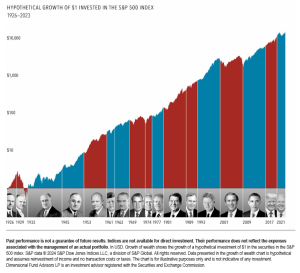

Despite the potential for short-term market volatility during election cycles, historical data suggests that long-term growth opportunities remain available to disciplined investors, regardless of who occupies the White House.

Focus on What You Can Control

You can’t control the election outcome, but you can control your reaction to it. Instead of worrying about market movements or political changes, shift your focus to what you can manage. Your financial plan should be the “known” that you focus on, while all the other “unknowns”, though acknowledged, get pushed to the periphery. This is why, as a firm, we believe so strongly in providing holistic financial planning for our clients. More than that, when we build financial plans, we build them with market ups and downs in mind. Election-year volatility is just another challenge that your plan can withstand if you follow it with discipline.

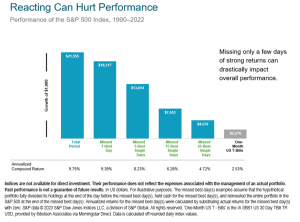

I believe the above chart gives one of the best cases for why we can’t afford to stray from staying disciplined to our financial plan and remaining invested through market volatility, even volatility caused by elections. No one can consistently time the market. Rather, it’s time in the market that will make the difference in wealth generation and successfully funding your financial goals.

Stay Informed, but Limit Media Consumption

While it’s important to stay informed during an election year, try not to let the unrelenting media barrage influence your financial decisions. The media tends to amplify, if not downright encourage, market reactions, which can heighten anxiety and lead to impulsive decisions. Stick to reputable sources and avoid making decisions based on headlines or political rhetoric.

During any times of uncertainty, Means Wealth stands ready to help clients plan and navigate forward. Please don’t hesitate to contact us with any questions or concerns you may have. We are here to help in any way we can.